2025 is set to bring about one of the most impactful shifts in recent shipping history: a reshuffling of major carrier alliances. With freight forwarders on high alert, one big question looms—what are the new alliances shaping the future of global trade?

This upcoming shift will see the formation of new alliances like Gemini Cooperation and Premier Alliance, while others, such as Ocean Alliance and MSC Standalone, evolve to tackle fresh challenges. These partnerships aren’t just business agreements; they play a critical role in stabilizing costs, optimizing supply chains, and addressing the growing demands of modern shipping.

To understand the full impact of these changes, it’s essential to first look at the purpose of carrier alliances and why they hold such importance in global trade.

Why Do Carrier Alliances Exist?

Strength in Collaboration

Carrier alliances exist to help the world’s largest shipping companies tackle some of their biggest challenges together. In an industry that faces constant changes—rising fuel costs, shifting demand, and unpredictable routes—these partnerships offer a way for carriers to pool resources and build a more resilient network.

At their core, alliances allow carriers to expand their reach and stabilize operations. By coordinating routes and sharing vessels, each carrier can access a larger network without shouldering the full burden of operational costs.

This collaborative model means they can cover more routes, optimize schedules, and provide better service reliability, benefiting not just the carriers but everyone in the supply chain.

Benefits for Freight Forwarders

For freight forwarders, these alliances translate to greater flexibility and efficiency. With more options and reliable schedules, forwarders can better plan their shipments, reduce risks, and often see cost savings.

New alliances in 2025, including Gemini Cooperation and Premier Alliance, promise even greater stability and connectivity, while MSC Standalone and Ocean Alliance evolve to address new challenges. This reshuffling promises to bring even more strength and stability to global trade

Current and Future Alliances: A Changing Landscape

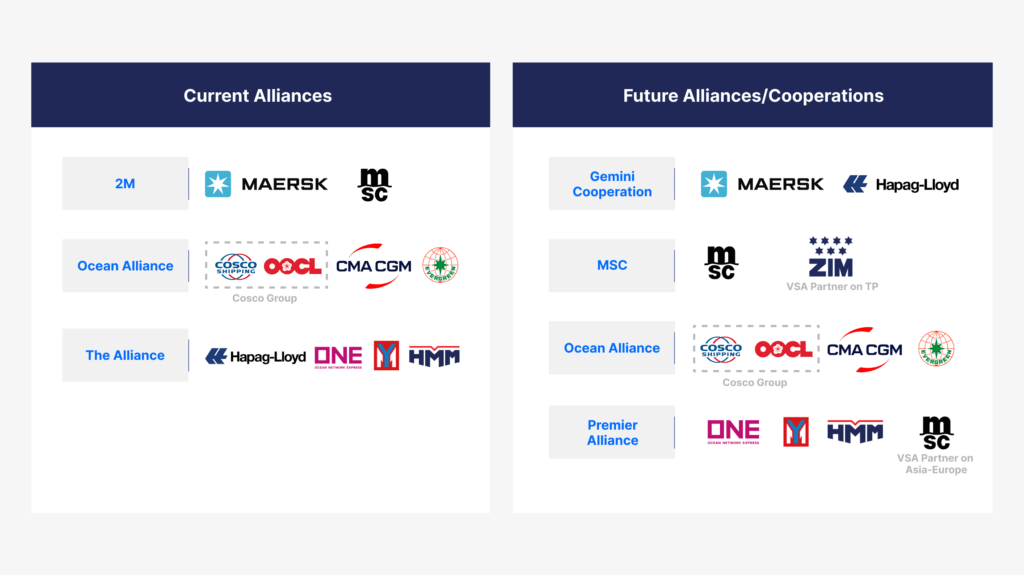

As of 2024, the container shipping industry is organized under three main alliances: 2M, Ocean Alliance, and THE Alliance. These partnerships cover major global trade routes, allowing carriers to share resources, enhance network reach, and maintain reliable service. However, 2025 will bring a significant restructuring, with new alliances such as Gemini Cooperation and Premier Alliance forming, while MSC moves forward independently and Ocean Alliance continues with adjusted roles.

A Breakdown of the 2025 Carrier Alliances

As the carrier landscape shifts, alliances are evolving to address new challenges and opportunities in global trade. Each brings unique strengths and strategic goals that will shape the future of shipping. Here’s a closer look at what they bring to the table.

1. Gemini Cooperation

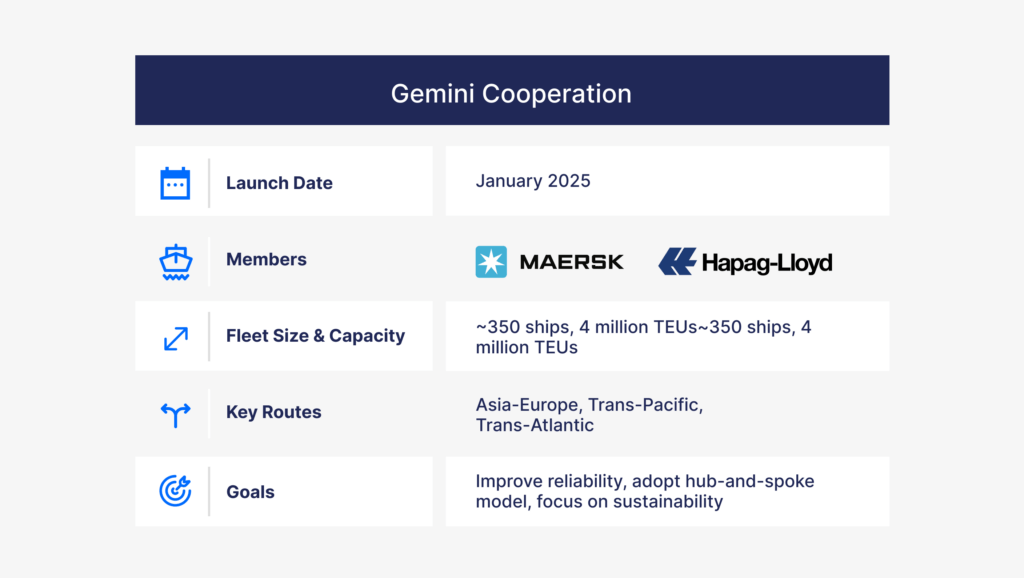

In January 2025, Gemini Cooperation will emerge as a strategic alliance between Maersk and Hapag-Lloyd. This partnership aims to improve service reliability on key global routes, especially across the Asia-Europe and Trans-Pacific lanes.

Gemini will utilize a hub-and-spoke model, enabling efficient routing through central hubs and ensuring wide network coverage with cost-effective operations. Both carriers are committed to sustainable growth, with joint initiatives to reduce their carbon footprint.

With expanded coverage and frequent sailings, Gemini is expected to offer freight forwarders a stable and environmentally responsible network.

2. Ocean Alliance

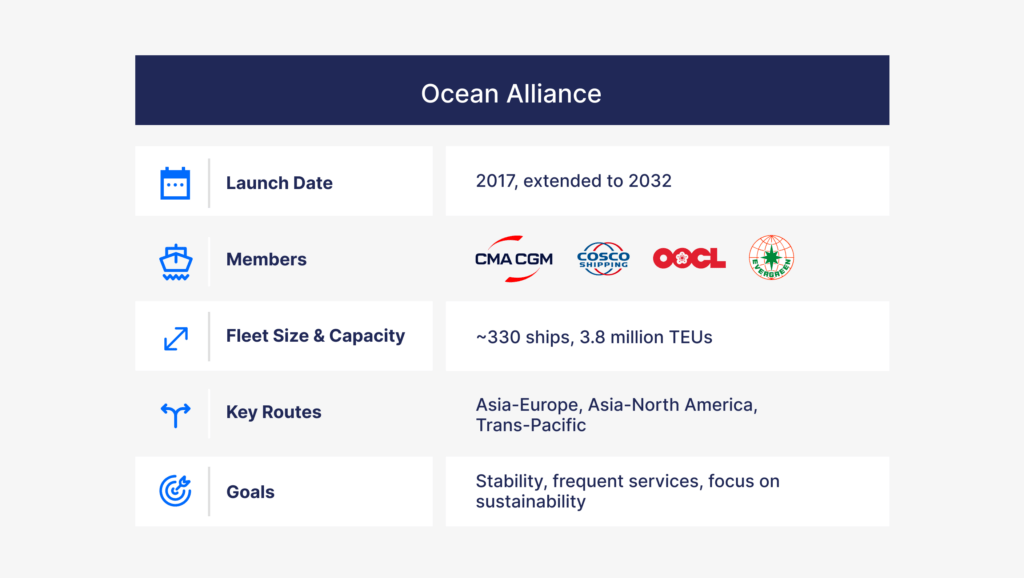

Formed in 2017 and extended until 2032, Ocean Alliance consists of CMA CGM, COSCO Group, OOCL, and Evergreen. This long-standing group prioritizes stability and high-frequency services across east-west trade lanes.

Ocean Alliance continues to be a dependable choice for freight forwarders seeking steady access to major global routes. Its commitment to sustainable practices includes significant efforts to reduce carbon emissions and improve efficiency across its network.

3. Premier Alliance

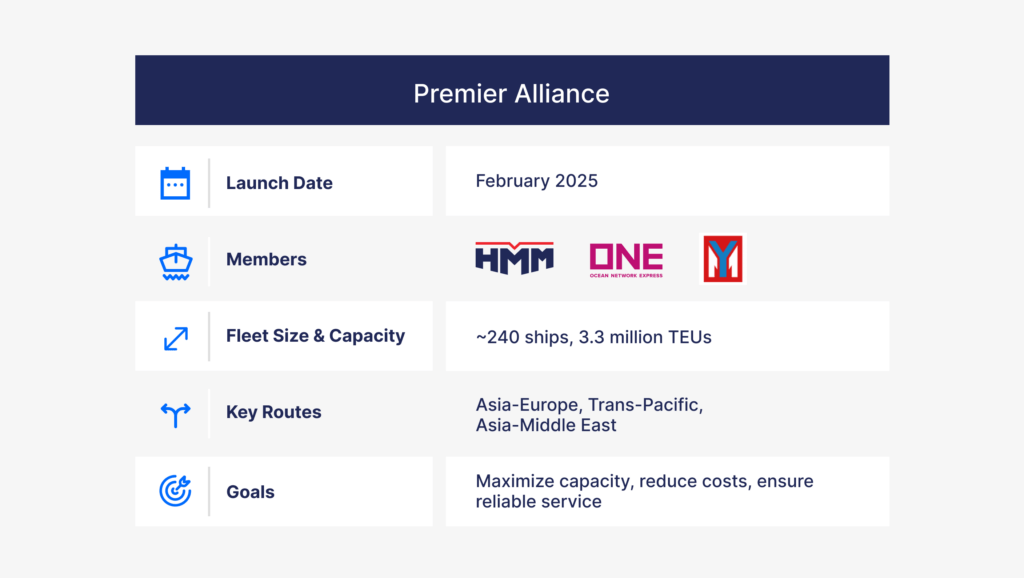

Premier Alliance, launching in February 2025, is a new partnership formed from the restructuring of THE Alliance. It brings together HMM, ONE, and Yang Ming, focusing on optimizing capacity and reducing operational costs across high-demand routes, especially Asia-Europe and Asia-Middle East.

With frequent services on essential trade lanes, Premier Alliance aims to provide freight forwarders with reliable and cost-effective shipping options, especially beneficial for those needing dependable access to the Middle East and Asia-Pacific regions.

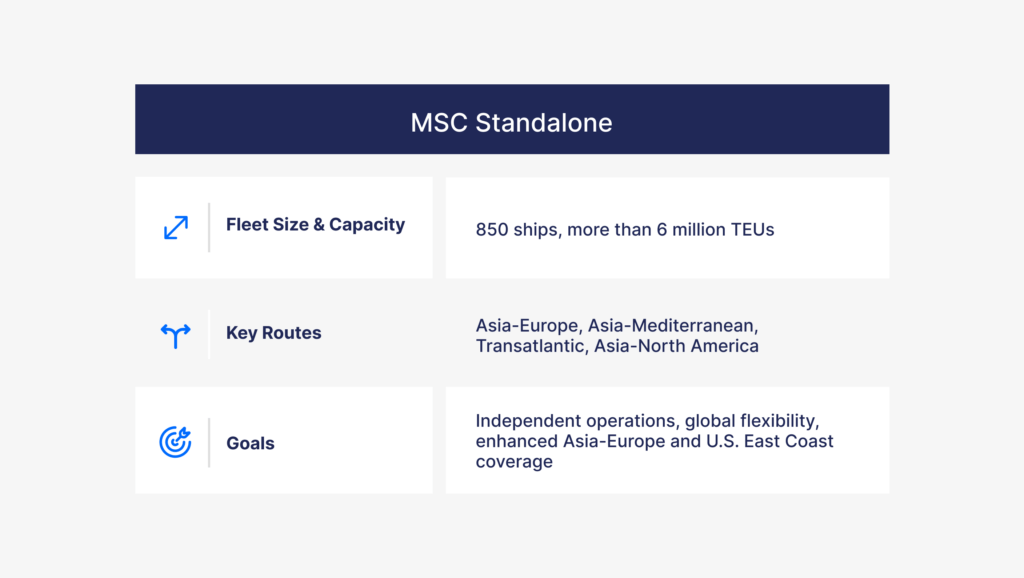

4. MSC Standalone

With the 2M alliance between MSC and Maersk ending in January 2025, MSC has announced its shift to an independent East-West network. This move allows MSC to establish a fully autonomous network across critical global lanes, including Asia-Europe, Asia-Mediterranean, Transatlantic, and both East and West Coasts of North America. The network will offer routing flexibility via both the Suez Canal and the Cape of Good Hope, connecting over 1,900 direct port pairs, and ensuring diverse transit options for shippers.

In parallel, MSC has secured slot exchange agreements with the Premier Alliance (comprising ONE, HMM, and Yang Ming) to strengthen its Asia-Europe reach, along with a partnership with ZIM for U.S. East Coast and Gulf routes. This strategy enhances MSC’s global service scope, supported by its large fleet capacity of over 850 vessels.

Key Challenges and Questions

- Challenges in Gemini’s Hub-and-Spoke Model The Gemini alliance’s hub-and-spoke strategy is drawing skepticism, with some experts warning that it may prove costly and inefficient on key routes. Feeder delays and priority shifts to direct calls could also undermine service reliability. For more on why some experts believe this approach may struggle, explore more here.

- Ambitious Reliability Goals Gemini has set a 90% reliability target, aiming to deliver high consistency for customer confidence. While some industry experts view this as challenging given typical logistics disruptions, Gemini leaders remain optimistic, emphasizing their commitment to achieving this benchmark as a competitive edge. For more insights into Gemini’s positive outlook, explore the Xeneta Summit.

- Sustainability and Stability in Ocean Alliance Ocean Alliance, the longest-standing alliance, must now balance sustainability initiatives with stable, high-frequency services, especially as operational costs climb. Maintaining eco-friendly practices without sacrificing schedule reliability will be a key factor in its success.

- Independent Operations for MSC MSC’s post-2M transition to independent operations will test its ability to maximize fleet utilization while relying on strategic slot exchanges, especially on routes like Asia-Europe. As MSC moves forward autonomously, success will largely depend on flexible and efficient fleet management. Read more about MSC’s standalone strategy here.

- Customer Trust Through Realistic Promises To stand out in the alliance race, Gemini is focusing on building trust by setting realistic delivery expectations and clear communication. Enhancing schedule transparency and reliability could help position Gemini as a dependable choice.

This approach, as explored in The Loadstar, may prove transformative in meeting the rising expectations of customers in today’s competitive shipping landscape.

Preparing for the New Shipping Alliances: Key Steps for Freight Forwarders

- Diversify Carrier Relationships With alliances reshaping, forwarders should build partnerships across multiple carriers to ensure flexible service options and reduce dependency on any single alliance.

- Monitor Network Changes Stay informed on each alliance’s updated routes and schedules to anticipate adjustments that could impact client needs, such as Premier Alliance’s increased focus on Asia-Pacific and U.S. West Coast routes.

- Strengthen Risk Management New alliance structures may bring logistical challenges like port congestion. Forwarders can prepare by optimizing costs and staying ready for variability in transit times.

- Leverage Digital Tools for Visibility and Rate Management With shifting alliance networks, freight forwarders can rely on tools like Cargofive to adapt seamlessly. Cargofive enables proactive rate management, streamlined contract updates, and optimized route planning, while providing real-time tracking to maintain smooth operations across global networks.

Looking Ahead

As alliances reshape the global shipping landscape, freight forwarders who proactively adapt their strategies—through diversified partnerships, digital tools, and operational resilience—will be best positioned for success. By staying flexible and informed, forwarders can turn these changes into opportunities to enhance service and efficiency.

AUTHOR